Poland is an increasingly popular destination for expatriates and foreign workers due to its robust economy, rich history, and vibrant culture. If you’re planning to work or live in Poland, it’s crucial to understand the country’s income tax system to ensure compliance and make the most of your financial situation. In this article, we’ll provide a comprehensive guide to income tax in Poland for foreigners, covering tax rates, deadlines, tax return forms, and other essential information.

Spis treści

Tax Residency in Poland

First and foremost, it’s crucial to determine your tax residency status in Poland. Your tax liability will depend on whether you are a resident or non-resident for tax purposes. Typically, individuals are considered residents if they spend at least 183 days in Poland during a tax year. Residents are subject to tax on their worldwide income, while non-residents are taxed only on income earned in Poland.

Tax Rates

Poland has a progressive tax system with several income tax rates, ranging from 17% to 32%. As of my last knowledge update in September 2021, the following income tax rates apply:

- Income up to PLN 85,528: 17%

- Income over PLN 85,528: 32%

It’s essential to check for any changes in tax rates since my last update, as tax laws may have evolved.

Tax Deductions and Allowances

Poland offers various deductions and allowances that can help reduce your taxable income. Some common deductions and allowances include:

- Personal Allowance: All taxpayers are entitled to a personal allowance, which reduces their taxable income.

- Family Allowances: Families with children may be eligible for additional allowances, depending on the number of children and their ages.

- Health Insurance Contributions: Contributions to the Polish National Health Fund (NFZ) are tax-deductible.

- Pension Contributions: Contributions to private pension funds may also be tax-deductible.

- Deductions for Specific Expenses: Certain expenses, such as charitable donations and education costs, may be deductible.

Deadlines for Filing Income Tax Returns

Income tax returns in Poland must be filed annually by individuals by April 30th of the year following the tax year. For example, for income earned in 2022, the tax return must be filed by April 30, 2023. However, it’s essential to monitor any updates to deadlines and requirements, as these can change over time.

Tax Return Forms

To file your income tax return in Poland, you’ll need to complete the appropriate tax return form. The most common form for individuals is the PIT-37, which covers various types of income, including employment income and rental income. Self-employed individuals may need to use different forms, such as the PIT-36 or PIT-28, depending on their specific circumstances.

It’s essential to ensure that you have the most up-to-date tax return forms and instructions, which can be obtained from the website of the Polish Tax Administration (Ministerstwo Finansów).

Tax Compliance and Assistance

Complying with Poland’s tax regulations can be complex, especially for foreigners who may not be familiar with the local tax system. Seeking professional assistance from tax advisors or accountants with expertise in international tax matters can be invaluable. They can help you navigate the tax code, optimize your tax situation, and ensure that you meet all filing and payment obligations.

Tax Return for Foreigners- conclusion

Understanding income tax in Poland is vital for foreigners working or living in the country. Familiarize yourself with your tax residency status, applicable tax rates, deductions, and allowances. Stay up-to-date with deadlines and ensure you use the correct tax return forms. If in doubt, seek professional assistance to help you navigate the intricacies of Poland’s income tax system. Being tax-savvy will not only keep you compliant but also enable you to make the most of your financial situation while enjoying all that Poland has to offer.

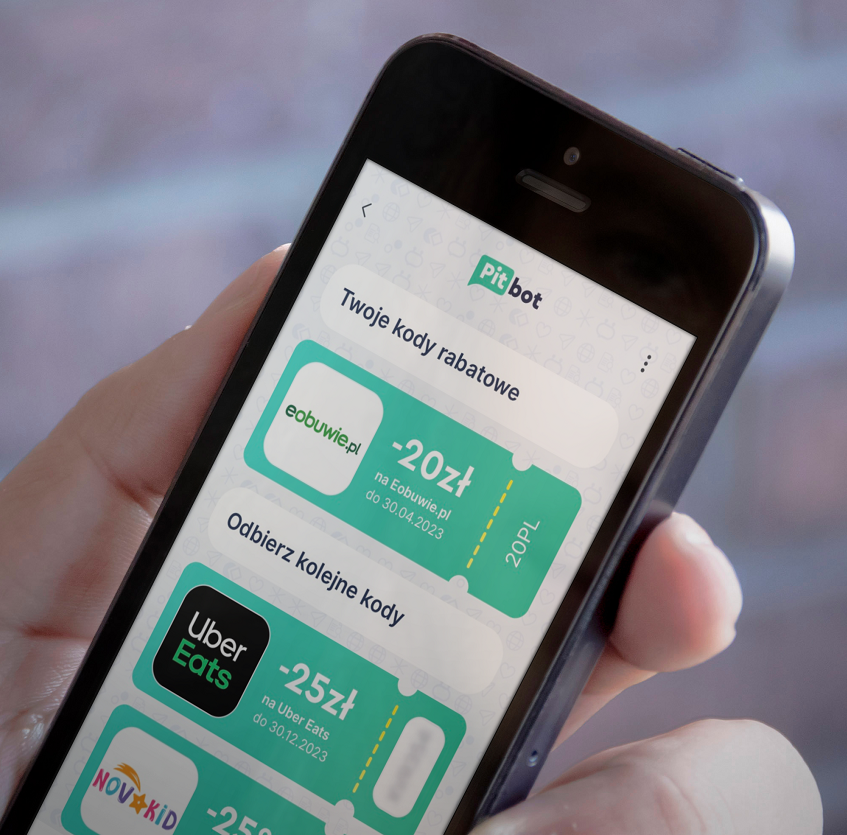

Foreigner-friendly PitBot, i.e. fast, simple and convenient online PIT settlement

We are well aware that tax matters are never pleasant topics. It is no different when it comes to preparing a return and sending it to the relevant tax office – even more so if you are abroad. That is why we have created a very easy-to-use online PIT settlement application – PitBot, which can be used today by any foreigner who is subject to tax liability in Poland. We encourage you to test the program, where you can count on full support at any time – don’t worry about ignorance of the regulations, our algorithm will correctly help you fill in your return in a few minutes.