Employment in Poland is regulated by a set of laws and regulations that ensure both employees and employers have clear guidelines to follow. In this article, we will explore various aspects of employment in Poland, including average salaries, minimum wage, employee rights, annual leave entitlements, sick leave, and different forms of employment contracts.

Spis treści

Average Salary and Minimum Wage

The average gross monthly salary in Poland varies depending on the industry, region, and occupation. As of my last knowledge update in September 2021, the average monthly gross salary was around 5,000 to 6,000 Polish złoty (PLN). However, it’s essential to note that salaries can differ significantly between urban and rural areas, with higher wages generally found in major cities.

Poland also has a statutory minimum wage, which is typically reviewed and adjusted annually. As of my last update, the minimum wage was set at PLN 2,800 gross per month. This rate may have changed, so it’s essential to verify the current minimum wage with the relevant authorities.

Employee Rights

Polish labor law provides employees with several rights, including:

- Working Hours: In general, the standard workweek in Poland consists of 40 hours, with eight hours per day. Overtime may be required but is usually compensated with higher pay rates.

- Annual Leave: Full-time employees are entitled to paid annual leave, typically ranging from 20 to 26 working days per year, depending on the length of employment and other factors.

- Sick Leave: Employees can take sick leave in case of illness, with compensation provided by the Social Insurance Institution (ZUS).

- Maternity and Parental Leave: Maternity leave is available for mothers, allowing them to take time off work before and after childbirth. Parental leave is also available for both parents to care for their child.

Annual Leave Entitlement

Annual leave entitlements in Poland depend on various factors, including the length of employment, age, and other circumstances. On average, employees are entitled to 20 to 26 working days of paid leave per year. These leave days should be agreed upon between the employer and employee, taking into account the needs of the workplace.

Sick Leave

Employees in Poland have the right to take sick leave in case of illness or injury. During sick leave, employees are entitled to a portion of their salary, which is provided by the Social Insurance Institution (ZUS). The length of sick leave and compensation depends on the severity of the illness and the employee’s situation.

Maternity and Parental Leave

In Poland, maternity leave is granted to mothers before and after childbirth. Additionally, parental leave is available for both parents to care for their child. The length of maternity and parental leave can vary, but it typically extends for several months to allow parents to bond with and care for their newborn or adopted child.

Forms of Employment Contracts

In Poland, there are various forms of employment contracts, including:

- Umowa o Pracę (Employment Contract): This is a standard employment contract that provides the most extensive set of employment rights and protections. It is commonly used for full-time positions.

- Umowa Zlecenie (Contract of Mandate): This type of contract is more flexible but provides fewer rights and benefits to the employee. It is often used for part-time or temporary work.

- Umowa o Dzieło (Contract for Specific Task): This contract is suitable for work on a specific project or task and is often used for freelancers or self-employed individuals.

Which type of contract is better depends on individual circumstances and the nature of the work. Employment contracts provide more comprehensive rights and benefits, but they also come with greater employer obligations.

Salary tax in Poland – conclusion

Understanding the employment landscape in Poland, including salary levels, employee rights, leave entitlements, and contract types, is essential for both employers and employees. It’s crucial to stay informed about the latest labor laws and regulations to ensure a fair and legally compliant working relationship in Poland.

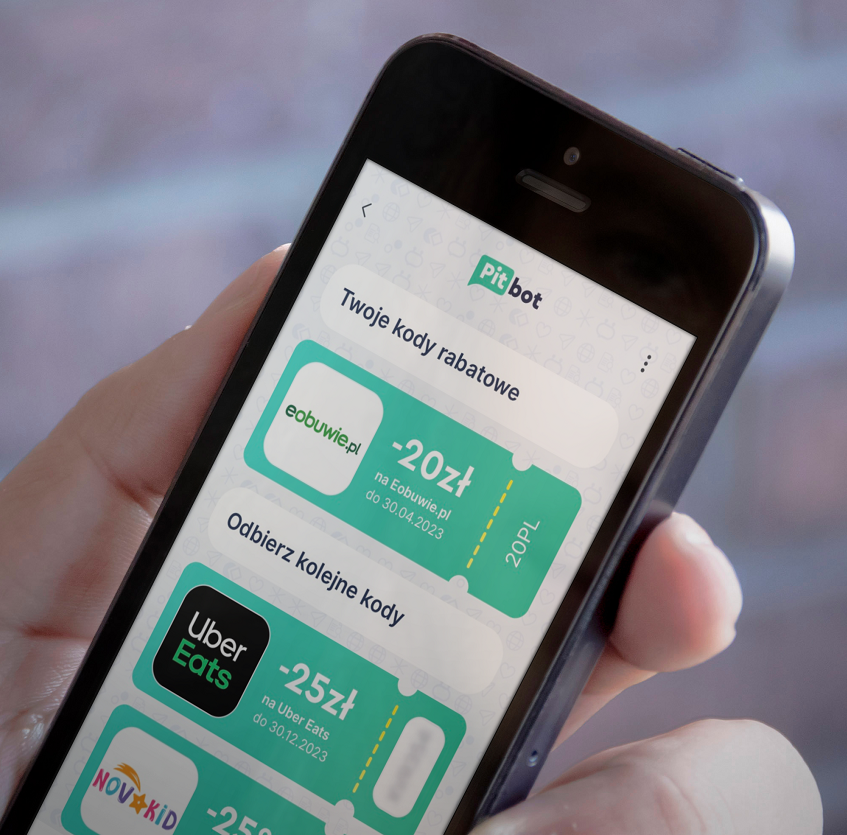

Foreigner-friendly app PitBot, i.e. fast, simple and convenient online PIT settlement

We are well aware that tax matters are never pleasant topics. It is no different when it comes to preparing a return and sending it to the relevant tax office – even more so if you are abroad. That is why we have created a very easy-to-use online PIT settlement application – PitBot, which can be used today by any foreigner who is subject to tax liability in Poland. We encourage you to test the program, where you can count on full support at any time – don’t worry about ignorance of the regulations, our algorithm will correctly help you fill in your return in a few minutes.