Are you a foreigner, but are you currently residing in Poland and undertaking legal earnings in the country? If so, today’s short entry is for you. In the rest of the article you will learn the most important information about PIT 37, the most popular tax in Poland. Find out what exactly this form of tribute is, who is subject to the obligation to settle PIT, by when and how you can file your tax return to save yourself potential problems with the Polish tax office. You are welcome!

Spis treści

- 1 Who has to settle income tax? How does it look like for foreigners?

- 2 How to settle PIT 37 as a foreigner living in Poland?

- 3 Foreigner vs. PIT-37 and PIT-36

- 4 How much is PIT income tax in Poland?

- 5 Settlement for foreigners: by when should you settle your PIT?

- 6 Foreigner-friendly PitBot, i.e. fast, simple and convenient online PIT settlement

What is PIT?

PIT is an abbreviation for Personal Income Tax, meaning income tax. This form of tribute applies to individuals who earn income, which makes it classified as a so-called direct tax. PIT in Poland covers income from various sources:

- from employment (employment contract, contract for specific work, contract of mandate),

- business activity,

- freelance work,

- pensions,

- benefits

- literary, artistic, scientific, journalistic, educational activities.

Who has to settle income tax? How does it look like for foreigners?

All persons over the age of 18 who legally earn income in Poland are subject to personal income tax in Poland. The PIT itself is levied on Polish tax residents (on the total income) – remember that as a foreigner you can also possess resident status in this country. How.

Whether you are a resident or not depends on the length of your stay in Poland. If it is longer than 183 days during the year, you acquire the right to this title. Whether or not you are a resident also depends on whether or not you have a so-called “center of life interests” in the Republic of Poland, which include, for example, your own apartment in Poland, family, etc.

Note: non-residents are also obliged to pay PIT in Poland – in their case, however, the tax is levied only on income earned in the territory of the Republic of Poland.

How to settle PIT 37 as a foreigner living in Poland?

Let’s get to the heart of the article, i.e. how to settle income tax with the Polish tax authorities as a foreigner?

The settlement itself is based on submitting the annual PIT tax return (the acronym also refers to the settlement form, which is worth remembering). On the basis of this document, one pays tribute or seeks a tax refund (an overpayment is due when the amount of advance payments made is higher than the value of the tax liability).

If you want to settle your PIT in Poland, you should reach for the right form, on which you should list all income, expenses incurred, income, deductions, as well as the tax-free amount.

For people coming from outside Poland, there are two options for settling PIT in Poland: using the PIT-37 or PIT-36 form. Which one should you choose?

Foreigner vs. PIT-37 and PIT-36

Which form to reach for depends on the type of income you earn. If you came to Poland for work and have the status of a Polish tax resident, at the end of the year you should receive a PIT-11 from your employer – information about income and PIT contributions paid. Based on this form, you should prepare the aforementioned return: PIT-37 or PIT-36.

If you have not Polish citizenship, work in Poland on the basis of a legal contract and have received a PIT-11 at the end of the tax year (by the end of February of the following year), you should settle your tax on the PIT-37 declaration. If you are a foreigner, work in Poland on the basis of a legal contract AND earn income from your business activity, the appropriate settlement form for you is PIT-36.

How much is PIT income tax in Poland?

How much tax you will pay in Poland depends on the income you earn. This is because there are two tax thresholds in the Polish tax system:

- Tax threshold I, in which the income limit is PLN 120,000 and the tax rate is 12%,

- Tax threshold II, which is 32% and applies to income in excess of PLN 120,000 (only the excess is charged, up to PLN 120,000 the tax is still 12%).

Settlement for foreigners: by when should you settle your PIT?

The standard deadline for settling PIT is the last day of April of the year following the year in which income from work was earned. However, if you want to settle for 2022, the return (PIT-37 or PIT-36) must be delivered no later than May 2, 2024 (April 30 and May 1 are public holidays).

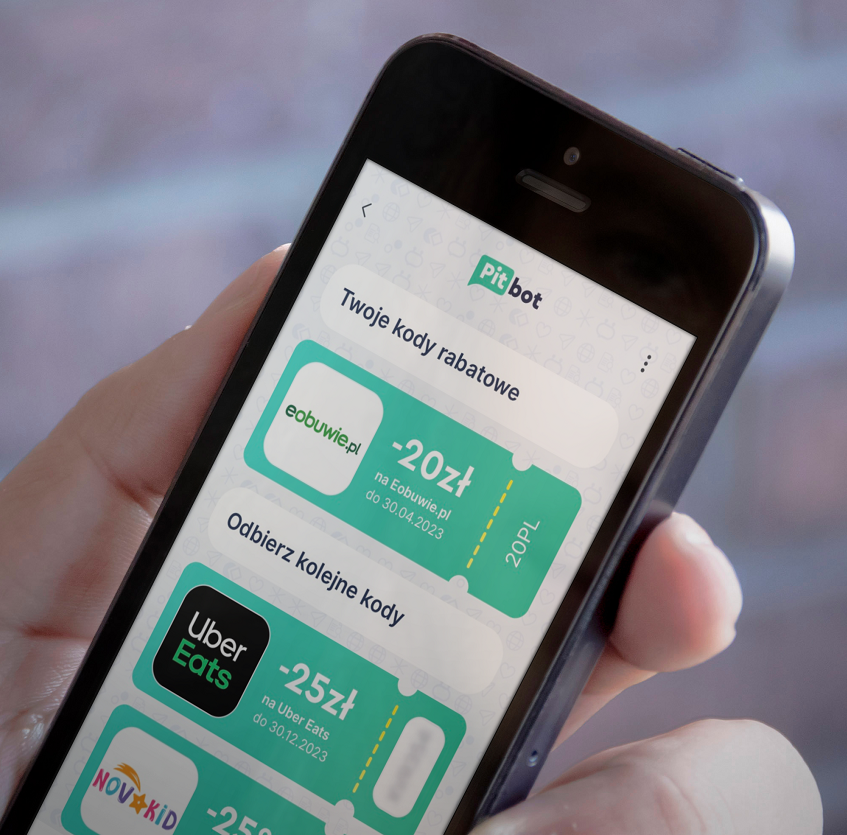

Foreigner-friendly PitBot, i.e. fast, simple and convenient online PIT settlement

We are well aware that tax matters are never pleasant topics. It is no different when it comes to preparing a return and sending it to the relevant tax office – even more so if you are abroad. That is why we have created a very easy-to-use online PIT settlement application – PitBot, which can be used today by any foreigner who is subject to tax liability in Poland. We encourage you to test the program, where you can count on full support at any time – don’t worry about ignorance of the regulations, our algorithm will correctly help you fill in your return in a few minutes.